You can obtain free credit scores safely from authorised financial institutions, credit bureaus, or banks. Most people in the United States will be able to access their scores without impacting them, as only soft inquiries impact their scores and are protected under federal law.

In this article, you will find information about where to find your score, how often to obtain it, and what to expect when checking your score according to industry standards.

Table of Contents

What Is a Credit Score and Why Does It Matter?

A credit score is represented by three digits and is used to measure how likely you are to pay back what you borrow and how well you manage your debts. The average credit score in the United States ranges from 300 to 850. The higher your score is, the lower the risk to lenders.

Your credit score is used by banks and lenders to determine whether you will be approved for:

- Loans and interest rates

- Credit Cards

- Mortgages

- Rent

- Insurance Premiums

Regularly checking your score will allow you to monitor for fraud, see how you’re progressing toward your goals, and assess whether it’s time to begin preparing for a large financial obligation.

Can You Check Your Credit Score for Free?

Yes, everyone is legally entitled to receive one free credit report, and you can also receive multiple free credit scores from various sources.

You can check your score without harming it because most free score checks only involve a soft inquiry, which does not impact your credit rating.

Key Free Access Options:

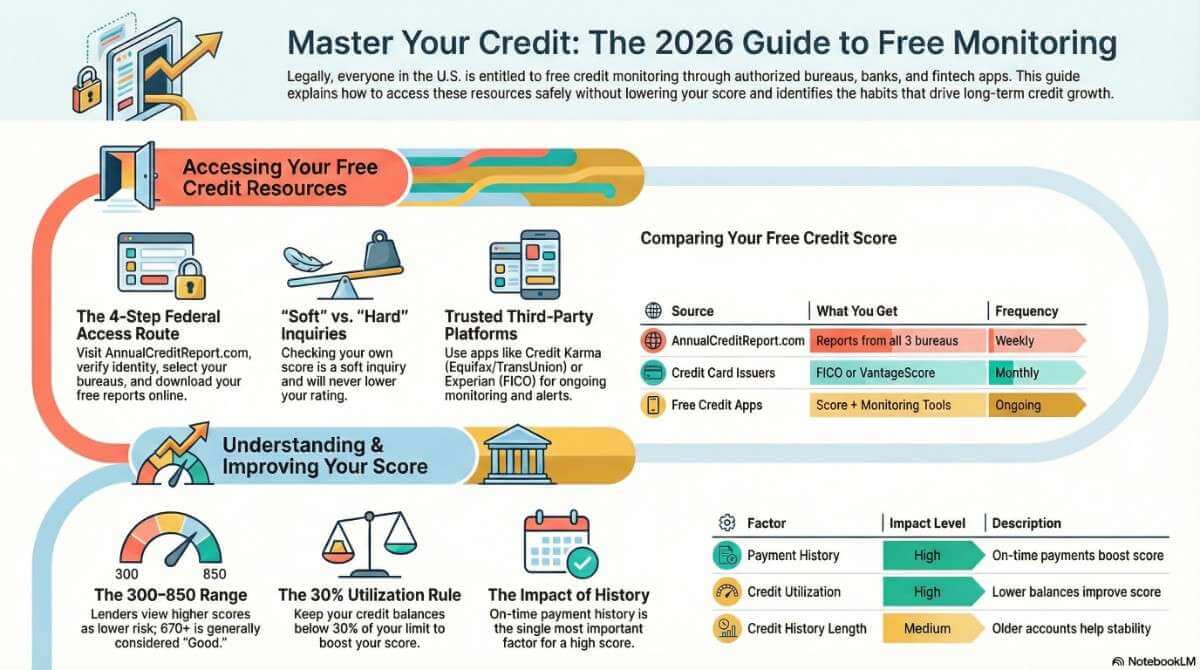

| Source | What You Get | Frequency |

| AnnualCreditReport.com | Free credit reports from all 3 bureaus | Weekly (currently available) |

| Credit card issuers | FICO or VantageScore | Monthly |

| Free credit apps | Score + monitoring tools | Ongoing |

| Credit bureaus | Score + report (limited free access) | Varies |

Get Your Free Annual Credit Report at AnnualCreditReport.com

AnnualCreditReport.com is a website that is authorised by federal law to provide you with your free credit reports from the following credit reporting agencies:

While the majority of information contained in your credit reports is related to your credit history, you can find out information that will affect your credit score by reviewing your credit report.

How to access your report:

1. Go to www.AnnualCreditReport.com

2. Verify your identity.

3. Choose one, two, or all three of the credit bureau reports.

4. Download or view your free report online.

Experts recommend checking at least one of your credit reports every three months to monitor for changes throughout the year.

Get a Free Credit Score from a Bank or Credit Card Company

Many credit card issuers and banks offer free credit scores to their customers. Most of them are updated monthly and provide detailed information on how your credit score is calculated.

Below are several credit card issuers and banks that give customers free credit scores:

- Discover (free FICO score for everyone)

- Capital One CreditWise

- American Express MyCredit Guide

- Chase Credit Journey

Accessing your free credit score is very easy since it is integrated into your bank’s online access system.

Use Free Credit Monitoring Platforms

Third-party fintech services now offer free access to credit scores and alerts, along with educational resources on their platforms. Most of these services utilize the VantageScore models, which are similar to your FICO score.

Popular free credit score apps:

| Platform | Key Features | Best For |

| Credit Karma | Scores from Equifax & TransUnion, alerts | Beginners |

| Experian Free Account | Experian FICO score, report updates | Detailed tracking |

| NerdWallet | Score + financial recommendations | Budget-conscious users |

| WalletHub | Daily score updates | Frequent monitoring |

These services often generate revenue by recommending different financial products, but are still offered free of charge to users.

Request Your Credit Score Directly from Credit Bureaus

By visiting the credit bureaus’ websites, consumers can also request their credit score directly from one of the bureaus. Most of these websites also offer a limited trial or free access to create an account to view:

- Credit score updates

- A summary of the credit report

- Identity theft alert information

While there may be a charge for premium features, basic access is typically provided to you at no cost.

How Frequently Should You Look at Your Credit Score?

Experts suggest reviewing your credit score at least monthly to remain informed about suspicious activity.

When You Should Monitor Your Credit Score More Frequently

- When you are starting the process of applying for a new loan or mortgage

- After you have cleared as much debt as possible

- When you are trying to build or repair your credit

- After being the victim of identity theft

- Continually tracking your credit will help you learn how your financial behaviours impact your credit score on a long-term basis.

Does Your Credit Score Go Down When You Check It?

No, checking your credit score does NOT impact your credit score as a soft inquiry and will not affect your credit decision.

Hard inquiries take place when lenders check your credit to apply for a loan or credit card. It may lower your score by a small amount on a temporary basis.

By being aware of the distinction between a “soft inquiry” and a “hard inquiry,” you will be more likely to monitor your credit regularly without worrying about hurting your credit score.

Key Factors that Affect Your Credit Score

Knowing what impact your score has allows you to identify changes in your score after checking your score.

Major credit score factors

| Factor | Impact Level | Description |

| Payment history | High | On-time payments boost score |

| Credit utilization | High | Lower balances improve score |

| Credit history length | Medium | Older accounts help stability |

| Credit mix | Medium | Diverse accounts strengthen profile |

| New inquiries | Low | Lower balances improve the score |

Improving these factors gradually leads to sustainable score growth.

Checking Your Credit Score: Tips for Improving It

It’s not enough to check your credit score; you also need to do something with the information you find. Changing some of your daily habits can make a big difference over time.

Here are some practical ways to build credit:

- Always pay your bills on time.

- Keep your credit utilization below 30% of your available limit.

- Don’t apply for new credit unless you really need it.

- Keep your oldest account(s) open, if possible.

- Dispute any errors that you find in your report.

Following these steps will make your credit profile stronger and increase your chances of getting approved for loans and credit cards in the future.

Things That Will Ruin Your Ability To Monitor Your Credit Score

Most consumers do not understand exactly how credit monitoring works or how to best take advantage of their own credit monitoring, so they are missing out on the benefits credit monitoring can provide.

Examples include:

- Ignoring reports and only watching scores.

- Relying on third-party sites that are not trustworthy.

- Only checking once a year – you should really check a few times a year.

- Being scared of small fluctuations in your score

- Ignoring alerts for identity theft.

Being informed about your credit is key to keeping your monitoring efforts effective.

Final Thoughts:

There are now many ways for people living in the U.S. banking system to check their credit score at no cost. By accessing their credit report via the federal government, utilizing the credit score provided by their bank, and using a fintech platform, consumers can monitor their financial health without spending any money.

The most important thing is to monitor regularly and build good habits around how you use credit. Doing this will ensure you continue to have good credit and be able to take advantage of more financial opportunities than those who don’t monitor their credit or use it responsibly.

FAQs

Are there any free ways to find out my credit score?

You can obtain your credit score at no cost through various entities, including some banks, credit card companies, and third-party providers like Experian or Credit Karma.

What is a good credit score?

By FICO’s accounts, a good score is typically between 670 and 739. A score that is between 740 and 799 is considered very good, while a score that exceeds 800 is considered excellent.

Can I check my credit score without using my credit card?

Yes, you may check your credit score without using your credit card by utilizing free services provided by the credit reporting bureaus and accessing your reports through federally authorized services, e.g., AnnualCreditReport.com.

What distinguishes a credit report from a credit score?

Credit reports provide detailed information about your credit accounts, payment history, and other relevant information. Credit scores are numbers based on how you have performed on those accounts and payment histories, which show lenders how risky you are to lend money to.

Which credit score do lenders use most?

FICO scores are the most widely used by lending institutions and creditors to make lending decisions. Some lenders provide VantageScore models for borrowers to use for educational purposes or to monitor creditworthiness.